Quick payroll calculator

Rates can be found on the Student Accounts web page. Our free CPF Calculator shows your contribution for each every donation type.

How To Calculate Payroll Taxes Wrapbook

Click the Customize button above to learn more.

. Advanced Mode Quick Calculator. Click the Customize button above to learn more. Times are calculated in hours and minutes eg 4230 as well as in decimal notation 425 hours.

PR Date DDMMYYYY CPF Donation Type. It processes employees salaries with just a single click making the whole payroll management quick and easy. The time card calculator supports lunch breaks.

To try it out enter the employees name and location into our free online payroll calculator and select the salary pay type option. Request for Taxpayer Identification Number TIN and Certification. How do you calculate turnover rate.

The quick ratio calculator exactly as you see it above is 100 free for you to use. Tax rates increase as income rises and only one standard deduction can be claimed on each tax return regardless of the number of jobs. People and businesses with other income.

There are a number of different payroll deductions that can be deducted from an employees paycheck each pay period. Free Online Timecard Calculator with Breaks and Overtime Pay Rate Enter working hours for each day optionally add breaks and working hours will be calculated automatically. If you would like to see a more detailed explanation we invite you to head on over to our comprehensive step-by-step guide.

SAP Payroll - Quick Guide SAP Payroll is one of the key modules in SAP Human Capital Management. SNAP expects families receiving benefits to spend 30 percent of their net income on food. The salary paycheck calculator can help you estimate FLSA-exempt salaried employees net pay.

Instructions for Form 1040 Form W-9. Easily produce a work hours timesheet for any given week with this free timesheet calculator with lunch breaks and use the resulting time card for payroll purposes. The Jamaica Tax Calculator includes tax years from 2002 to 2022 with full salary deductions and tax calculations.

California Paycheck Quick Facts. The Central Provident Fund CPF is an employment-based scheme that acts as a mandatory savings plan for Singaporeans and Permanent Residents PR. These range from FICA taxes contributions to a retirement or 401k plan child support payments insurance premiums and uniform deductions.

Try online payroll today. Apart from this there is one more type of claim known as the slab based claim. Use this free online payroll calculator to estimate gross pay deductions and net pay for your employeesor yourself.

TD1 Total Claim Amount TD1P Total Claim Amount. If you want to customize the colors size and more to better fit your site then pricing starts at just 2999 for a one time purchase. POPULAR FORMS.

The numbers of active employees at the beginning B and end of the month E and the number of employees who left L during that month. Families with no net income receive the maximum benefit which is tied to the cost of USDAs TFP a diet plan intended to provide adequate nutrition consistent with the Dietary Guidelines for Americans that low-income households can. Although this is sometimes conflated as a.

Free calculator to find the actual paycheck amount taken home after taxes and deductions from salary or to learn more about income tax in the US. First and foremost we have to give Uncle Sam his due. Your Payroll Month and Year.

Before you can start the journey of calculating payroll taxes you first have to figure out how youre rewarding your employees for their time ie. See Washington tax rates. Some of these payroll deductions are mandatory meaning that an employer is legally obligated to withhold.

It calculates payroll deductions for the most common pay periods such as weekly or biweekly based on exact salary figures. Exempt means the employee does not receive overtime pay. You will find the PDOC at Payroll Deductions Online Calculator.

Federal Payroll Taxes. If you want to customize the colors size and more to better fit your site then pricing starts at just 2999 for a one time purchase. Lowest price automated accurate tax calculations.

Fall 2022 and Spring 2023. This is used to calculate the remuneration for each employee with respect to the work per. Payroll Payment Date DDMMYYYY Prov Of Employment.

Well go through a quick overview of what you need to know when it comes to calculating federal payroll taxes. Self Assessment is a system HM Revenue and Customs HMRC uses to collect Income TaxTax is usually deducted automatically from wages pensions and savings. SmartAssets California paycheck calculator shows your hourly and salary income after federal state and local taxes.

A few common types of slab based claims are LTA. Automated payroll inputs. Payroll Deductions Online Calculator PDOC You can use this application to calculate payroll deductions for all provinces and territories except Quebec.

Prov Of Employment TD1 Total Claim Amount. To calculate the monthly employee turnover rate all you need is three numbers. Calculating Benefit Amounts.

Individual Tax Return Form 1040 Instructions. WebTOD Canadian Payroll Tax Deduction Calculator. Then enter the employees gross salary amount.

Federal Payroll Taxes. The ira calculator exactly as you see it above is 100 free for you to use. For starters heres a quick rundown on federal payroll taxes.

California income tax rate. Luckily our Florida payroll calculator is here to assist with calculating your federal withholding and any additional contributions your business is responsible for. Use our free check stub maker with calculator to generate pay stubs online instantly.

The city of San Francisco levies a gross receipts tax on the payroll expenses of large businesses. Try paystub maker and get first pay stub for free easily in 1-2-3 steps. If you want to calculate total gross pay enter hourly pay rate and choose.

TD1P Total Claim Amount. Therefore if you have more than one job at a time or are married filing jointly and both you and your spouse work more money should usually be withheld from the combined pay for all the jobs than would be withheld if each job was considered by itself. Time Card Calculator.

Some of the top companies using GreytHR are Toshiba Da Milano Kotak and more. Calculating you income tax and payroll deductions including National Insurance Scheme NIS National Housing Trust NHT Education Tax ET and Human Employment and Resource Training HEART is simple with the Jamaica Tax. This calculator is meant to help you estimate your tuition and fees costs FOR ONE SEMESTER.

While a 0 state income tax is saving you from some calculations you are still responsible for implementing federal payroll taxes. Besides its in-built payroll calculator offers flexibility to handle multiple salary structures. Whether youre paying them hourly on a salary or by another method.

While individual income is only one source of revenue for the IRS out of a handful such as income tax on corporations payroll tax and estate tax it is the largest.

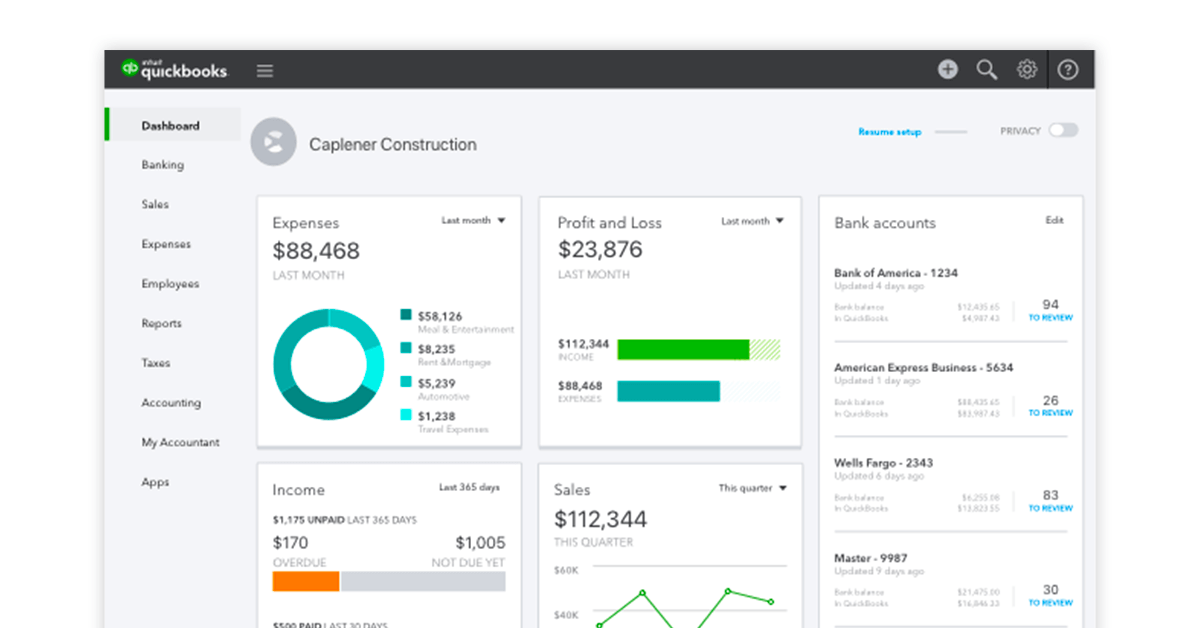

One Day Processing Now Available For Quickbooks Payroll

10 Best Free Payroll Calculator In India Fy 2021 22 Paycheck Calculator

How To Calculate Payroll Here S A Quick And Smart Method Timecamp

Hourly Cost Calculator In Quickbooks Online Projects Youtube

10 Best Free Payroll Calculator In India Fy 2021 22 Paycheck Calculator

New Feature For Quickbooks Desktop Employee Pay Adjustment History Report

Top 6 Free Payroll Calculators Free Paycheck Calculator App Timecamp

What Is Payroll And How Are Payroll Calculations Done

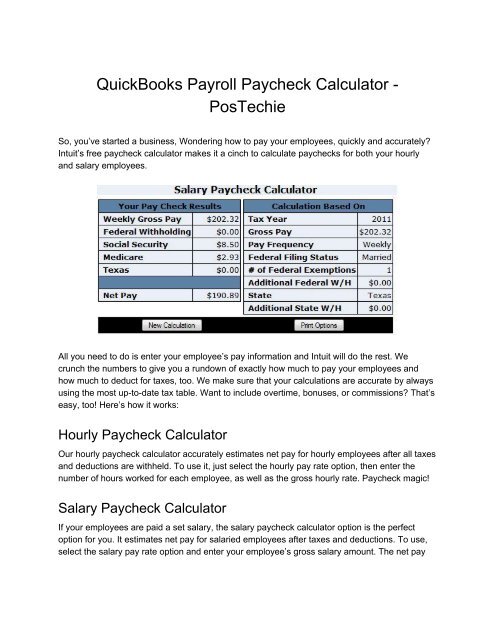

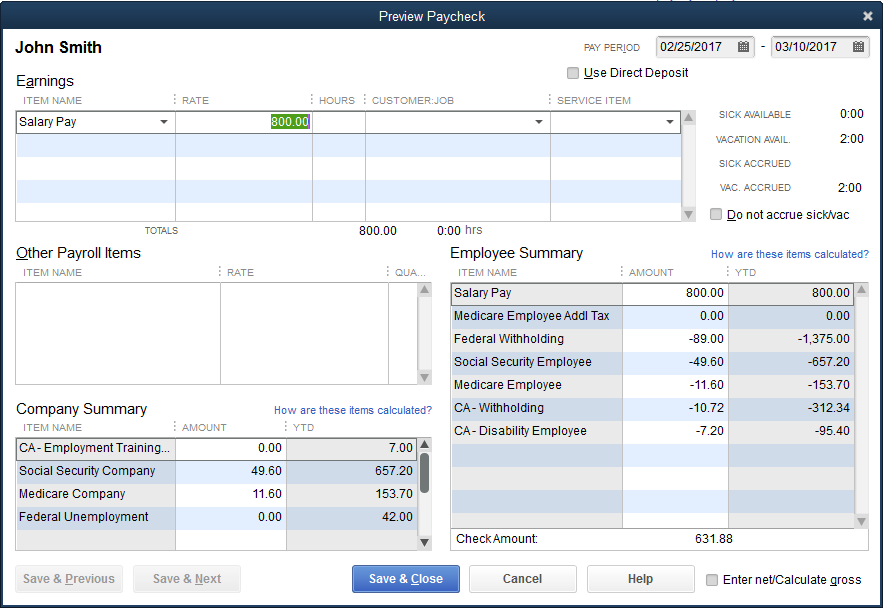

Intuit Quickbooks Payroll Paycheck Calculator Postechie For Quickbooks

Gusto Vs Quickbooks Payroll Compare Pricing Product Features And More

Quickbooks Paycheck Calculator Intuit Paycheck Calculator

Pay A Partial Or Prorated Salary Amount In Quickbooks Desktop Payroll

How To Calculate Payroll Taxes Methods Examples More

Top 6 Free Payroll Calculators Free Paycheck Calculator App Timecamp

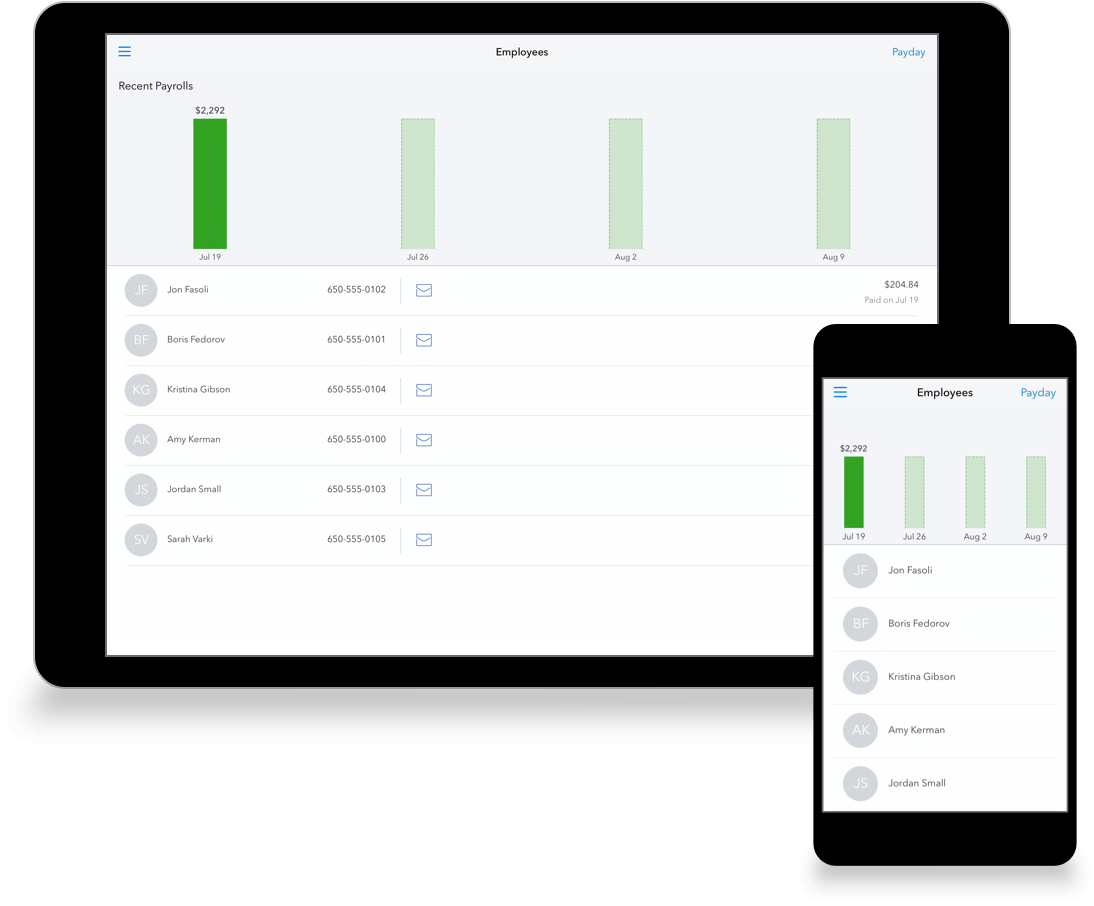

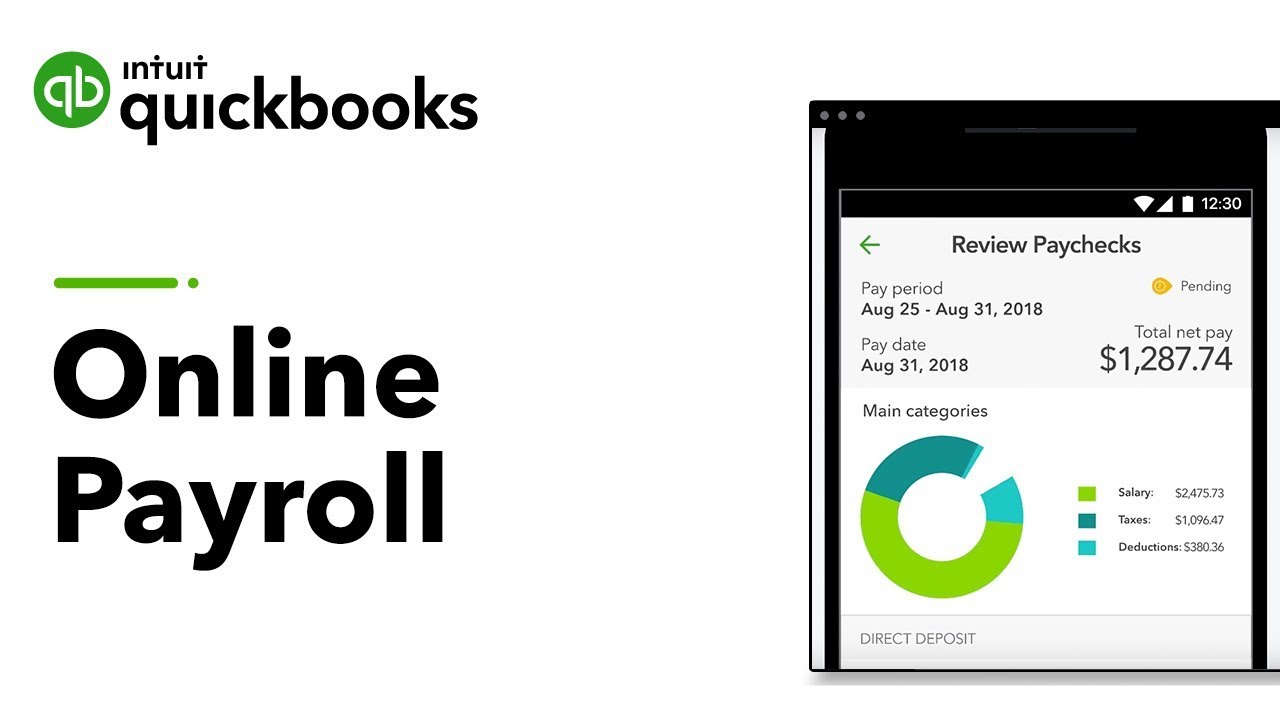

Payroll App For Small Business Run Payroll From Mobile With Quickbooks

Connect Quickbooks Payroll Hr Benefits With Quickbooks Online Intuit

Top 6 Free Payroll Calculators Free Paycheck Calculator App Timecamp